Updated: Category: Transformation

In times of rapid change, good advice is valuable. The rising demand for advice in our industry has led to a flurry of self-declared “trusted advisors” ready to instill their insights onto unsuspecting customers. The most tempting ones even offer their services “ for free”. Too good to be true? Probably.

If you’re not paying, you’re not the customer

What’s even better than good advice? Good advice that doesn’t cost anything. In their personal lives, people look for advisors when they buy a home or make a large investment. Correspondingly, there’s a whole industry of brokers and advisors to help with that. And, amazingly, most of them are free. Now deep down we know that there ain’t such a thing as a free lunch (aka TANSTAAFL). “Free” usually just means that the money flows in a less obvious way. But the psychology of getting something for free is appealing nevertheless. Who doesn’t love “a free gift with purchase”, even when knowing that it’s both a pleonasm (all gifts are free) and an oxymoron (it isn’t free if it requires payment). Those 3 nights’ free accommodation in a luxury resort are indeed hard to pass up, despite the fact that they’re obviously funded via high-pressure sales pitch for time share condos.

Another place where a lot of stuff is “free” is the internet. When the digital giants like Google and FaceBook started to offer their services for free, made possible by creative monetization schemes, an insightful slogan made the rounds: if you’re not paying, you’re not the customer, but the product. The same is true for engaging advisors.

Who’s paying then?

If you’re the product, though, you ought to be wondering who’s the customer. In Google’s and FaceBook’s case that answer is fairly obvious: the advertisers.

In case of financial advisors, if your “free advisor” is recommending products based on the highest kick-back, the customer is the provider. But there’s a problem: the only source of money is you, so you are paying for it! This conflict has been bubbling long enough that many regulators require financial advisors and mortgage brokers to make their earnings transparent to their clients. Alternative models such as upfront brokers, who forgo kickbacks in favor of a fixed fee, have been around for a while, but remain a niche. Getting something “for free” is just too appealing.

The single-source-of-money principle holds true in enterprise IT as well. Whatever you get, for free or not, is ultimately paid for by you, simply because no one else injects money into the system – putting companies churning through investor money aside for a moment. So it pays (pun intended) to have a closer look at how you are ultimately charged for your “free” advice.

Paid advice: consulting

The classic IT advisors come from management consulting firms, who have a broad view across the industry and leverage a huge network of experts. They also charge you essentially by the hour. Personally, I like this model because of its simplicity and transparency: if the value your advisor brings exceeds the cost, then everyone goes home happy. The thing to watch out for is consultants who keep enough left to do for them to land another gig.

Free advice: vendors

A lot of IT advice comes “for free”, though. Actually, after a good decade of paid-by-the-hour consulting and half a decade going native, I was also a “free” advisor for complex and strategic customers, usually working alongside pre-sales and professional services. While engaging with customers without having to negotiate rates and signing purchase orders is pure bliss, balancing customers’ interests with your employer’s can take some finesse.

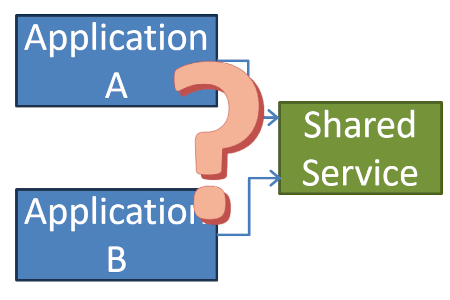

To understand who’s the customer in this relationship, it’s worth having a closer look at where your “free, trusted advisor” is anchored in their respective organization. Interestingly. each major cloud provider seems to use a different model that most closely matches their company DNA (see org charts).

Sales

Sales is the one who spends most time with the customer and most directly benefits from their success. Thus, placing trusted advisors alongside pre-sales staff, seems natural, as is the case for many folks with the title “field CTO”. However, the proximity to sales also makes it most difficult for the advisor to put the customer’s interest first as they’re going to be on a sales plan, meaning they are compensated by the revenue they help generate. In a consumption-based model like cloud, this can work out as the customer’s success translates into higher consumption and thus into higher revenue. However, different products carry different margins and often a customer could save a lot of money by scaling down or migrating to a simpler product.

The cloud provider with most history in enterprise sales mostly follows this model - likely it’s worked well for them in the past.

Engineering

Another place to anchor the trusted advisor is engineering. Initially, this seems beneficial as it’s detached from sales and can provide a valuable channel to the engineering teams. However, much of what you’d need from a trusted advisor goes beyond product considerations - there’s a whole slew of people who can address product-specific topics: solutions architects, customer engineers, professional services, product managers, and the like. So there’s the risk of internal competition and a potential conflict of interest if the trusted advisor is affiliated with a specific product group. You might end up with a “trusted advisor” who is repeatedly pushing you to adopt the latest shiny object so they can earn points with engineering by recruiting a pilot customer. Also, advisors being organized by product area hints at an inside-out as opposed to an outside-in attitude.

Naturally, the most engineering-centric of the cloud providers leans toward this model.

Marketing

An initially unlikely location to place the trusted advisors is Marketing. However, on second look it makes a lot of sense. Marketing is the furthest removed from the revenue streams (look at all the schwag they buy and hand out…) and aims at generating long-term leads and growth. As a result, having your trusted advisor placed there is most likely to get you trusted advice.

Personally, I enjoy engaging with marketing and find it to be a highly symbiotic relationship: speaking at executive events has allowed me to build many new relationships and marketing appreciates me bringing thought leadership and customer examples into the conversation. Also, marketing is much more than events and working together on account-based marketing can be highly productive.

Not surprisingly, the most customer obsessed cloud provider uses this model.

Should you trust your trusted advisor? Questions You Should Ask

While understanding how the money flows is an important first step, you’d also want to get to know your advisor a bit better. We’ll cover that in the second part.

Photo Credit: George Clooney in Michael Clayton, a surprisingly good movie.

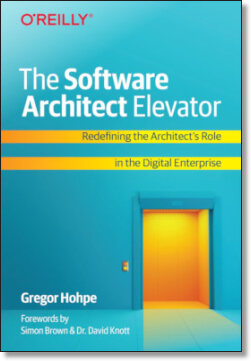

Make More Impact as an Architect

The Software Architect Elevator helps architects and IT professionals to take their role to the next level. By sharing the real-life journey of a chief architect, it shows how to influence organizations at the intersection of business and technology. Buy it on Amazon US, Amazon UK, Amazon Europe