Updated: Category: Transformation

In times of rapid change, good advice is equally valuable and hard to come by. Just hiring a hit(wo)man is unlikely to do the trick, so you’ll need something better than that.

As someone who has budget to spend you’re likely to attract a variety of helpers, including so-called “trusted advisors”, who sometimes even come “for free”. How much should you trust these folks, though? Do you simply get what you pay for?

Recalling that one of the reasons IT is so complex lies in the misalignment of incentives between supplier and consumer, it’s good to ask them some questions.

Advice on picking an advisor

Having been on both sides of giving and receiving advice as a consultant, vendor, and enterprise chief architect provided me with many examples of fruitful advisor relationships, but also with several cases where the trust was misplaced. To avoid painful (and expensive) mistakes, it’s good to carefully select whose advise to follow.

First, you’ll want to tests whether the advisor candidate properly speaks CTO, so they don’t waste your time. Additionally, I found the following aspects to be good indicators for the quality of your candidate advisor:

- Incentives

- Pedigree

- Original Thought

Incentives: How are you rewarded?

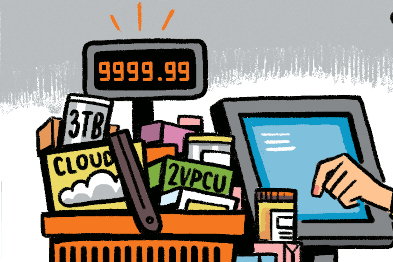

Understanding who pays for your advisor is helpful, especially if you’re not paying directly. After all, we all know that there ain’t such a thing as a free lunch (aka TANSTAAFL). When the advice comes from a vendor, it’s generally funded by sales, engineering, or marketing. In general that’s fine but you need to recall that the only real source of money in this relationship is you, the customer. You are paying for the advice one way or the other, so you should get commensurate value for it.

Recall that not all payment is made in money. You are likely also paying with information that you are sharing. Or with the time you are spending with your advisor. Indirect costs include a weakened negotiation position due to information shared with your supplier. It may be a worthwhile investment, but it’s clearly a cost also. Nothing is ever free, including trust.

Besides knowing who foots the bill, you’d also want to know how your advisor is incentivized, i.e. how their performance is evaluated or their bonus is being set. This may be a somewhat personal question but a good exercise in transparency for someone who wants to earn your trust.

For folks on a sales plan, like account reps or presales staff, the answer is relatively straightforward: they are rewarded by the revenue (or commitment of revenue) they generate. For consumption-based services like cloud, this can still lead to an alignment of objectives as your success leads to more consumption. However, advice may be skewed by products carrying different margins and incentives. Naturally, scaling down or migrating to a simpler product would work against your advisor’s incentive.

Advisors might also be rewarded for bringing input to engineering. While at the surface that sounds helpful, it can easily lead to a misalignment of incentives. For example, your advisor may be associated with a specific or novel product and hence may be incentivized to push customers towards this product when there isn’t a technical need for it. In any case, you should get more than a channel to engineering from your advisor.

NPS (Net Promoter Score) can be a sensible metric to evaluate advisors. However, NPS is also fairly easily gamed, for example because customers can’t judge the quality of the advise they receive (or don’t know the alternatives), so they simply rate people by how friendly they are.

Understanding your advisor’s incentives is bound to be somewhat fuzzy, but it’s a good baseline for further evaluation.

Pedigree: What qualifies you to advise me?

Second, you’d want to make sure that the advice you are receiving is based on actual experience as opposed to merely reading marketing material or watching other people do it. Sadly, trusted advisors that have spent actual time as part of a client organization are quite rare - apparently advising is easier (or more fun) than doing. Having spent five years transforming a major financial services organization from the inside makes me one of the exception to this rule - I always valued seeing IT from different perspectives.

One cloud provider in particular has recognized this and hired a very different set of advisors. While many vendor-based advisors come from career in presales or perhaps engineering, Amazon Web Services staffs their Enterprise Strategy team with senior IT decision makers who oversaw actual cloud migrations – a clever move as your advisor will essentially be a peer with actual enterprise experience, such as Mark Schwartz (he also writes great books).

Throughout my career I have observed that people change companies and titles quite regularly but rarely their real attitudes and core capabilities. So if someone started their career in hardware (pre-)sales or a decade in the processor industry (who always wants to move upstream but never quite manages) and then suddenly shows up as an authority in hybrid cloud software delivery platforms, you should be more than a little suspicious. Folks who never delivered software for a living rarely understand the real dynamics of software delivery beyond the buzzwords and marketing brochures. The same is true for that other person who pitches a “great deck on how we innovate” to you, but never spent a day as software engineer. This isn’t advice you’ll want – don’t be shy to politely decline.

Advisors can be clever, though, in answering this question, so you’ll need to listen carefully and have a close look at their LinkedIn profile. Sometimes, people bragging about their experience can unintentionally be funny: a fellow advisor who kept proclaiming to have built the data centers for XYZ cloud provider across the region once faced a clever customer who keenly observed that by moving to the cloud this is exactly the skill he doesn’t need anymore. Touché.

Original Thought: What can you do for me?

You need a trusted advisor because you need advice – for your company, your situation, your problems, and your context. Not for generic case studies and “success stories”. Your potential advisor therefore should be able to help you create plans, strategies, and architectures. A trustworthy advisor would be happy to share (sanitized/anonymized) such material they personally prepared for other customers. If your question leads to not much more than name-dropping of other customers, you should likely walk away: generating valuable advice is not a copy-and-paste activity.

It’s a good thing if your advisor connects you to other helpful folks from his outfit, for example specialists. But if you end up with a pure connection maker, you didn’t really get an advisor. You got just another presales or support person because that role should be played by your sales rep or customer engineer already. From a trusted advisor you should expect actual, original advice, even if they are “free” - after all you are paying for them indirectly.

Luckily, the internet makes it straightforward to look at documents, blog posts, or live presentations any potential advisor would have created. If someone wants to advise you on digital strategy and can’t be found in the digital world, you should wonder.

Lastly, worthwhile advisors are rare enough that they are likely to be known and visible in the industry. If your advisor brings independent thought, he or she will have a following of their own instead of just riding the vendor’s label. Always consider how much you would trust or respect that person if they came without the company logo. You’ll want someone to take your side, not another product sales person (nothing wrong with sales people, but honestly, they are quite easy to come by).

One more thing: Integrity

Understanding your advisor’s reward system, background and capabilities are a useful “background check”. However, as your trusted advisor should help you make major decisions, integrity and trustworthiness are likely the most important ingredients. Therefore, you have a few more questions to ask or things to observe.

Trust is known as the thing that’s built over 10 years and ruined in 10 seconds. It’s also a thing that’s binary - you don’t trust someone 85.6%. I have learned to become much stricter in allocating my trust and have found that those small warning signals, which you may easily ignore, are actually fairly reliable indicators.

So, for example, when that person who claims to have built data centers left and right “forgets” to mention that this was half a decade ago and he most recently was head of technical sales for a large hardware and software vendor - do you still trust that person? He may simply be highlighting his greatest achievements, but he may also “forget” to mention a major limitation in the product he is pitching to you. Judging people’s character isn’t easy, so you’ll have to decide for yourself - I know where I stand. No advice is better than bad or biased advice.

The most trusted advisor

History has shown us one very successful model of a trusted advisor: the court jester. As I discussed before, jesters are trustworthy because they have nothing to gain from the advice they give. They are also outspoken and sometimes even funny. Having some of those jester attributes can be healthy for a chief architect and also for an advisor!

Photo Credit: George Clooney in Michael Clayton, a surprisingly good movie.

Grow Your Impact as an Architect

The Software Architect Elevator helps architects and IT professionals to take their role to the next level. By sharing the real-life journey of a chief architect, it shows how to influence organizations at the intersection of business and technology. Buy it on Amazon US, Amazon UK, Amazon Europe